Procedure for filing VAT Returns in UAE

VAT In UAE

UAE is already getting accustomed to new form of taxation ‘VAT’. It’s been past a month that VAT has been implemented in UAE. Value-Added Tax or VAT is a tax on the consumption or use of goods and services levied at every channel of distribution till final sale. VAT is charged at a rate of 5% on most goods and services, with some exceptional cases. Procedure for filing VAT Returns in UAE is discussed below.

VAT is charged at 0% at the below main categories of supplies:

- Exports of goods and services to outside the GCC States that implement VAT

- International transportation, and related supplies

- Supplies of certain sea, air and land means of transportation (such as aircrafts and ships)

- Certain investment grade precious metals (e.g. gold, silver, of 99% purity)

- Newly constructed residential properties, that are supplied for the first time within 3 years of their construction

- Supply of certain education services, and supply of relevant goods and services

- Supply of certain Healthcare services, and supply of relevant goods and services

Below are Exempted Supplies

- the supply of some financial services

- Residential properties

- Bare land

- Local passenger transport

Insight View of VAT- Procedure for filing VAT Returns in UAE.

Need For VAT in UAE

The reform in the taxation system is a revolutionary step in the history of UAE. GCC countries have decided to implement taxation as part of the governments’ efforts to diversify revenues in the context of sharp decline in oil prices.

The UAE’s citizens and residents enjoy commendable public services, such as healthcare, roads, education, parks, social services and waste management. The cost of these services is paid for by the government. The introduction of VAT and Excise taxes will help the UAE diversify sources of revenue so that government departments can continue to deliver excellent public services and ensure a high quality of life for coming generations. This is also in line with a foreseen key pillar of the UAE’s Vision 2021 – The Sustainability of Infrastructure .

The introduction of VAT will help the UAE government to generate an estimated Dh12 billion worth of revenue in the first year, which will increase to Dh20 billion in 2019.Collection of VAT will boost government revenues.

Procedure for filing VAT Returns in UAE

Before that we should know who needs to register under VAT to file VAT Returns?

A company whose annual turnover is equal or above AED 375000 should register it self under the Federal Law before 2017. If the Annual Turnover is between AED 187,500 & AED 375,000/, it is optional for the company to be registered under UAE VAT law. Further, if it is less than AED 187,500/, the company need not register under this law.

However, for the ease of the business, supplier may not be registered if the business does not make any supplies which are eligible for 5% tax. %. If exception from registration is granted, then you will not submit regular tax returns and you will not be able to recover input tax incurred.

What is VAT Returns?

VAT Return, otherwise known as ‘Tax return’ is a periodical statement which a registered Entity needs to submit to the government authority. It is a formal documental declaration about income gained, loss incurred if any and VAT paid and levied on the aggregate goods and services sold for the pertaining quarterly period or monthly and remitted to government. The details and data to be furnished in the VAT return for the purpose of tax are specified in the UAE VAT executive regulations. All the details as required in VAT Return, needs to be prepared in accordance with the VAT Return format issued by the authority.

Why VAT Returns is important?

It is mandatory to file returns as government has to generate revenues for country’s betterment. It also has a check on the black money as returns are filed every quarterly. The possibility of money laundering is handicapped by periodical checks. No manual returns are accepted on the desk. It is mandatory that all the companies registering under VAT should go through online process of registration. This is basically adopted to avoid any kind of manual manipulation. Delay in filing tax return will be penalized by the tax authority.

When do I need to submit my VAT Return?

UAE taxpayers registered under VAT should file VAT returns with the Federal Tax Authority (FTA) on a quarterly basis. Returns must be filed according to the procedures specified in the VAT legislation, within 28 days from the end of the tax period. FTA may direct certain type of businesses to file the VAT return on monthly basis to avoid the risk of tax evasion and improve the monitoring of compliance adherence by the business. Taxpayers can file their returns online using e-services.

VAT Return Due Dates

FTA has extended dates with respect to the VAT return period. The FTA has provided the first VAT return period from January 1 to May 31 and subsequently on a quarterly basis. This means the first return will need to be filed on or before June 28 and later returns from June 1 to August 31, September 1 to November 30, December 1 to February 28-29. Businesses can strive to be fully compliant in terms of reporting VAT obligations to authorities.

All businesses must log onto the FTA’s website and check the tax period under their profile. Some businesses have been given one month and others have been given five months. FTA has relaxed the timeline for filing the first VAT return which would enable many businesses to gear up for the time loss.

Previously, the first tax return filing for companies with more than Dh150 million turnover was one month. For others, it was quarterly. Now, firms can file their first tax returns after four or five months in June as per the new timelines appearing on the FTA’s dashboard after log-in by a member company. Most of the micro, small and medium enterprises have been granted five months, four months and so on as their filing period for the first return.

This will enable various entities to cope up with VAT implementation requirements and ensure they are compliant to legal provisions.

Procedure for filing VAT Returns in UAE- How do I submit my VAT Return?

Once registered on the VAT portal, each taxpayer will be given a unique TRN and password for their online account on the website. These details are to be used to file returns online. Follow the steps below.

- Visit the online portal of the Federal Tax Authority at tax.gov.ae

Click the return filing option under the e-services section of the portal

3. Log in using your TRN and password

4. Fill in the VAT return form with the details of your business, transactions, tax liability, penalties (if any), etc.

5. Upload the required documents, bills, etc.

6. Verify the details filled by you and submit the form.

Procedure for filing VAT Returns in UAE

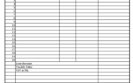

VAT Return Format Overview – featuring below requirements to be furnished by the VAT registered companies.

- The name, address and the TRN of the Registrant: The Tax Registration Number (TRN) provided by the FTA needs to be furnished in all the VAT Returns. Based on the TRN number, the name and address details are expected to be auto-populated.

- The date of submission: The VAT returns need to be submitted within 28 days following the end of the VAT return period. Here, the date on which returns are submitted will be captured.

- Tax Period: Tax Period is the return period to which the Tax Return relates. For example, for January to March’18, it will be Jan-Mar’18.

- Details of the Supplies (sales) made in the VAT return period: You need to furnish the value of supplies (sales) and output VAT collected during the return period. Also, the supplies need to be categorized into the following:

- Standard Rated Supplies: This includes all the domestic supplies on which 5% VAT is applicable. Further, these details need to be furnished at the emirates level as shown below:

- Standard rated supplies in Abu Dhabi

- Standard rated supplies in Dubai

- Standard rated supplies in Sharjah

- Standard rated supplies in Ajman

- Standard rated supplies in Umm Al Quwain

- Standard rated supplies in Ras Al Khaimah

- Standard rated supplies in Fujairah

- Zero rate Supplies: The details of notified supplies which are under Zero-rated list needs to be furnished in this section.

- Exempt Supplies: Supplies such as financial services, residential building etc. which are notified as exempt supplies need to be captured here.

- Reverse Charge Supplies: Supplies such as imports and other notified supplies on which the recipient or buyer is liable to pay VAT on reverse charge mechanism.

- Intra GCC Supplies: Supplies made to customers registered for VAT in other GCC implementing states and for which the place of supply is the other GCC implementing state needs to be captured here.

- Details of the expenses (Purchases) made in the VAT return period: You need to declare the value of expenses incurred on which you are eligible to recover Input Tax and the amount of Recoverable Input Tax in the VAT return period. Please note, the value of input tax credit which is restricted or which you are not eligible to claim, should be reduced from the total and only the net value needs to be mentioned. Also, the total expenses and recoverable Input Tax needs to be shown separately for standard rated expenses (on which 5% VAT was paid) and the expenses, subject to reverse charge.

- The total value of Due Tax and Recoverable Tax: You need to mention the total output tax collected and recoverable input tax during the return period.

- Payable Tax: This will be arrived at, after adjusting the Output Tax with Recoverable Input Tax. If output VAT is higher than input VAT, it will result in VAT Payable. Otherwise, it will be VAT refundable which can be carried forward to next return period or can be claimed as a refund.

The above are the some of the mandatory details which need to be furnished in the VAT return form. Apart from the above mandatory details which is applicable for most of the businesses in UAE, the return format consist other additional details listed below.

- Profit Margin Scheme

- Goods transferred to GCC implementing states

- VAT paid on personal imports via Agents

- Transportation of own goods to other GCC states

- Recoverable VAT paid in other GCC implementing states

- Tax Refunds for Tourists Scheme provided

- Declaration

Procedure for filing VAT Returns in UAE-How to e-file your VAT Returns using an Online VAT Accounting Software

Reach Accountant-Online VAT Accounting Software

The registered businesses are required to generate VAT returns in an acceptable format as prescribed by FTA and upload the return file in the portal. Therefore it is important for businesses to have appropriate software which helps in accounting VAT and has a capability to generate the return file in XML or Excel format.

On the basis of the uploaded return file, the e-tax portal will validate the file and accordingly the details from the file will be auto-populated in the online return form. The steps to file the VAT return are given below:

Generate the VAT return file from the Reach Online VAT Accounting software.

It is crucial for businesses to evaluate the right software as certified by the FTA, so that they are allowed to generate the VAT return file easily. It is very important for businesses to note that the VAT return file, generated only from the certified tax accounting software, will be allowed to be uploaded in the FTA’s e-tax portal. A certified tax accounting software refers to that software which meets the guidelines set by the FTA.

For the new era of VAT in UAE, Reach has developed software that plays a key role and it will define the success of your business in the field of compliance adherence. Reach Online VAT Accounting software will help the businesses in accounting and VAT with ease and generate accurate VAT return files in XML or Excel format.

Reach Online VAT accounting software helps in accounting the VAT records with in-built capabilities to prevent, deduct and allow seamless corrections of errors or discrepancies so that all the records and the returns are authentic .

Reach Accountant is certified by FTA as it meets and matches all the standards and criteria set by FTA. It is online VAT Accounting software which is FTA compliant.

1.Login to FTA e-tax portal using your login TRN and upload the return file.

After generating the VAT return file, you need to login to the FTA’s e-tax portal using the TRN. Using the e-tax portal upload option, you need to browse and select your return file.

2.Validation and Auto Fill VAT Return Details.

Once the file is uploaded, you need to click ‘Auto Fill VAT Return’ which will auto-populate the details from the VAT return file to the VAT return form in the FTA’s e-tax portal. Once this button is clicked, the FTA portal will validate or authenticate whether the uploaded file has been created by a certified tax accounting software. If the file is authenticated, only then the details will be auto-populated into the VAT return form. If the file is not authenticated, it will be rejected and an appropriate error message will be displayed.

- Submit VAT Return

Once the VAT return file is authenticated, you are required to fill the other details required by FTA and submit the VAT return .

Procedure for filing VAT Returns in UAE -How do I make a VAT PAYMENT?

VAT Tax Payment

Understanding key words in the calculation of VAT:

Input Tax:

In simple terms ,it means tax paid on raw material for the purpose of making the finished goods. You can reduce the tax that has been already paid on the inputs and pay the balance taxable amount. Thus, entire taxes paid are set off against the output tax liability and there is no cascading impact of taxes.

Example:

Mr.X ‘s company is a manufacturer of mango juice.Raw materials required are mangoes, sugar, acidity regulators and packaging materials.

| Input Material | Input Tax Paid |

| Mangoes | AED 100 |

| Sugar | AED 75 |

| Acidity Regulators | AED 50 |

| Packaging Material | AED 50 |

| Total | AED 275 |

Once the final product is made let the tax on output be AED500

Tax to be paid by the manufacturer =AED500 – AED275=AED225

Input Credit=AED275

Input Credit in VAT: A company can avail input tax credit only if it is registered with Federal Law.

Understanding with the formula:

VAT=Output TAX – Input Tax

Output tax: VAT collected on sales of goods and services.

Input Tax: Tax paid on purchase of raw materials.

If tax on inputs is greater than tax on output –> carry forward input tax or claim refund

If tax on output is greater than tax on inputs –> pay balance

Understanding Calculation Of VAT with a scenario:

Mr. Y a has a textile industry, with annual turnover being more than AED375000.He spends AED 200,000 for procurement of raw materials like yarn, dye etc.

Prevailing VAT rate of 5% is applied on 200,000 which is AED10, 000

Tax on the raw materials is that is Input Tax=AED10, 000

Assuming the finished product is sold for AED 400,000

Output Tax is 5% of AED 400,000 =AED20, 000

Therefore final VAT payable to Government is Output tax – Input Tax

That is AED 20,000 – AED10, 000 = AED 10,000

VAT Payment Online

The VAT payable determined after off-setting the Output VAT with Input VAT needs to be paid through the FTA portal. The Online VAT payment facility is provided in the FTA portal, wherein the registered businesses can remit the VAT payable.

When will I receive VAT REFUNDS?

Registered businesses whose input VAT (tax applied on the purchase of goods or services) is more than their output VAT (tax applied on the sale of goods or services) should indicate on their tax returns that they are eligible to receive VAT refunds.

VAT can be claimed under these scenarios:

| Input tax paid on expenses related to taxable supply | Fully recoverable by the registered VAT person |

| Input tax paid on expenses related to non-taxable/exempt supply | May not be recoverable by the registered VAT person |

| Input tax paid on expenses related to both taxable and non-taxable/exempt supply | Recoverable on a proportionate basis by the registered VAT person. The registered person needs to apportion their input tax between the taxable and non-taxable/exempt supplies. Businesses will be expected to use input tax (ratio of recoverable to total) as a basis for apportionment. Other methods may be used if they are fair and agreed upon by the Federal Tax Authority (FTA). |

Claim of Input Tax Credit

A entity can claim input tax credit on furnishing the below mentioned

A tax invoice or debit note issued by the registered dealer.

If the goods have been received in the lots or installment, credit will be available for the lst installment on producing the appropriate tax invoice

Possession of Goods and Services

The tax charged on your purchases has been deposited/paid to the government by the supplier in cash or via claiming input credit

Supplier has filed VAT returns

Therefore every input tax credit claimed is matched and validated before the reimbursement.

Exceptions on Input Credit

- It is possible to have unclaimed input credit. Being tax on purchases higher than tax on sale. In such a case, you are allowed to carry forward or claim a refund.

If tax on inputs is greater than tax on output –> carry forward input tax or claim refund

If tax on output is greater than tax on inputs –> pay balance

No interest is paid on input tax balance by the government

- You must be registered as a taxable person under VAT

- If the entity of registered taxable person changes due to sale, merger or transfer of business, then unused ITC shall be transferred to the sold, merged or transferred business

- Since VAT is charged on both goods and services, input credit can be availed on both goods and services (except those which are on the exempted/negative list).

- Input tax credit is allowed on capital goods.

Non Availability of Input Tax Credit for the following cases

- Input tax is not allowed for goods and services for personal use.

- No input tax credit shall be allowed after VAT return has been filed following the end of the financial year to which such invoice pertains or filing of relevant annual return, whichever is earlier.

- Input tax credit cannot be taken on purchase invoices which are more than one year old. Period is calculated from the date of the tax invoice.

- If depreciation has been claimed on the cost of capital goods, then they are not eligible for Input Tax credit.

- VAT can’t be recovered such as entertainment services to anyone not employed by the person, including customers, potential customers, officials, or shareholder or other owners or investors.

Matching Mechanism for ITC Monitoring

- A matching mechanism has been developed to make sure there is no duplication in claiming ITC.

- It ensures that inward supplies returns filed by receiver matches outward supplies returns filed by supplier.

- Matching mechanism also helps in matching ITC claims with customs paid where goods are imported by registered taxable person.

- Any discrepancy which arises post verification is intimated to both parties so that they can make necessary corrections within the prescribed time frame.

- Procedure for filing VAT Returns in UAE-What are the penalties for non-compliance of VAT

- Tax Evasion Penalties –

Tax evasion is where a person uses illegal means to either lower the tax or not pay the tax due, or to obtain a refund to which he is not entitled under law. The imposition of a penalty under tax law does not prevent other penalties being issued under other laws. Penalties are an integral part of any legislation for non-compliance with tax laws

Few examples of instances of tax evasion:

- Where a person deliberately provides false information and data and incorrect documents to the FTA;

- Where a person deliberately conceals or destroys documents or other material that he is required to maintain and provide to the FTA.

The revealed penalties range between Dh3,000 and Dh50,000 dependingupon intensity of the violation made by the organizations or individuals.

The regulations covers individuals, companies, tax agents and their legal representatives who come under the purview of this new VAT regulations. The penalties range from as low as Dh3,000 and go up to Dh50,000 depending on the offences committed by the entities or individuals.

As per the FTA regulations,

- If the person fails to keep required records and other information specified in the laws will be fined Dh10,000 in the first instance and Dh50,000 in case of repetition.

- If the person fails to submit data, records and documents related to tax in Arabic to authority when requested, he would be penalized Dh20,000.

Need to upgrade to Reach Online VAT Accounting Software :

Reach Accountant software is well designed to match all the needs for successful running of the business. The software can be used in different industries ,traders ,manufacturers, retailers, workshop ,business projects etc. It is an online VAT accounting software that can automatically manage your book of accounts, taxes, inventory, sales, purchases and more online quickly and securely.The VAT return filing process in UAE is very simple and easy. The businesses with the right tax accounting software will be able to file the returns effortlessly and save time

Benefits Of Reach Online VAT Accounting Software

Reach Online accounting software systems are rapidly evolving, giving business owners the ability to choose how and where they manage their finances. Whether at home or on-the-go, business owners are now able to execute administrative functions such as instantly viewing bank balances, tracking expenses, sending invoices ,supervising the work flow of branches through Reach online VAT Accounting Software thus making business more viable.There are many advantages of using an online accounting system including:

Reach online VAT accounting system can help you manage your business by improving your recordkeeping processes and give you the tools you need to analyze business results and make sound financial decisions.

- Online Access 24/7

- Cost Effective

- User Friendly

- Technical Support

- Efficiency

- Analysis –

- Security and Accuracy

- Inter Connectivity of Branches:

- Opportunities

- Scalability

Features Of Reach Online VAT Accounting Software

Accounting Management

Purchase Management

Customer Management

Vendor Management

Automatic Reminders

Barcoding

Receivable Management

Vat Management

Branch Management

User Management

Mobile App

Invoicing

Approvals Management

Sales Team Management

Asset Management

Job Cards

Forex Management

Point Of Sale

Gift And Discount Vouchers

Project Management

Production Planning

Quality Control

Batch Tracking

Order Management

Bank Reconciliation

Inventory Management

Sub Contractor Management

Consignment Sales

Quotation

E-Commerce Management

Purchase Order

Multilingual

Technology Used

Reach has implemented the latest technology Cloud Computing to handle day to day business transactions just a click away from your browser from any part of the world.

Cloud accounting software that is easily accessed online and an attractive option for large or small business owners. Companies that use cloud accounting require less initial server infrastructure to store data and don’t require IT staff to maintain or update the cloud accounting system. Get the spectacular benefits of cloud accounting as you seamlessly integrate with the powerhouse

Benefits of cloud accounting:

- Streamline billing and ordering processes

- Capture and store financial data to most accurately model and report on your finances

- Use Chatter to enable more effective collaboration across your organization

- Greater return on investment and real-time, multi-dimensional financial analysis

Blog Comments

Leave a Reply to Judi Cancel Reply

Popular posts

How to start Car Service Centre – Business Plan Free DownloadRoohi Shabir - 09 July

How to start Car Service Centre – Business Plan Free DownloadRoohi Shabir - 09 July How to start a Café in UAERoohi Shabir - 09 July

How to start a Café in UAERoohi Shabir - 09 July How to set-up a consulting business in UAERoohi Shabir - 08 July

How to set-up a consulting business in UAERoohi Shabir - 08 July Guide for opening mechanic shop in UAERoohi Shabir - 07 July

Guide for opening mechanic shop in UAERoohi Shabir - 07 July Automobile workshop tools listRoohi Shabir - 05 July

Automobile workshop tools listRoohi Shabir - 05 July

Categories

- Blog / 33

- Invoice / 8

- Uncategorized / 101

While the crazy propositions of Paddy Power can’t be found, everything else is available at Bet365.

We also tested the limits and compared the odds we found to the rest of the market. The results were great and Bet365 beats most bookies out there. The average margin is below 4.3% and often Bet365 had the best prices available.

So, here’s how we rated our experience with the bookie:

Before we declare the final rankings, we would like to clarify a couple of things. < To use the bet365 live streaming service, you must be logged in and have a funded account or to have placed a bet in the last 24 hours. Please see steps below to watch live streaming: Please note that geo-restrictions apply to specific events and competitions. Depending on your location there may be certain events not available in your area.

A1i9ak ht