How to make GST payment?

Under GST regime, every registered tax payer has to make GST payment and furnish GST returns on a monthly basis (small and medium businesses with annual aggregate turnover up to Rs. 1.5 crores file quarterly returns and pay taxes only on a quarterly basis, starting from the third quarter of this financial year i.e. October-December, 2017).

Tax payer has to make GST payment and file returns before due date to avoid interest, penalty, fees, etc. as applicable.

Let us understand the step-by-step process on how to make GST payment:

Procedure for making GST payment:

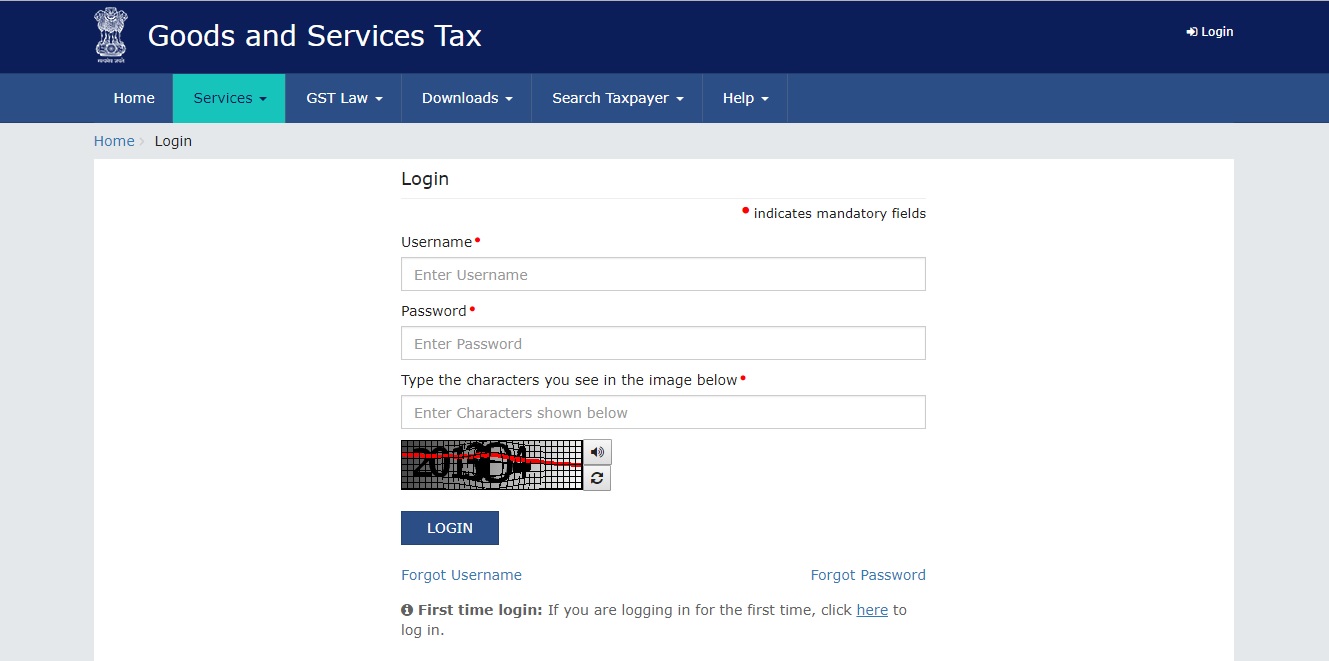

Login to GST portal https://services.gst.gov.in/services/login. Enter the user name, password, captcha and click “Login”

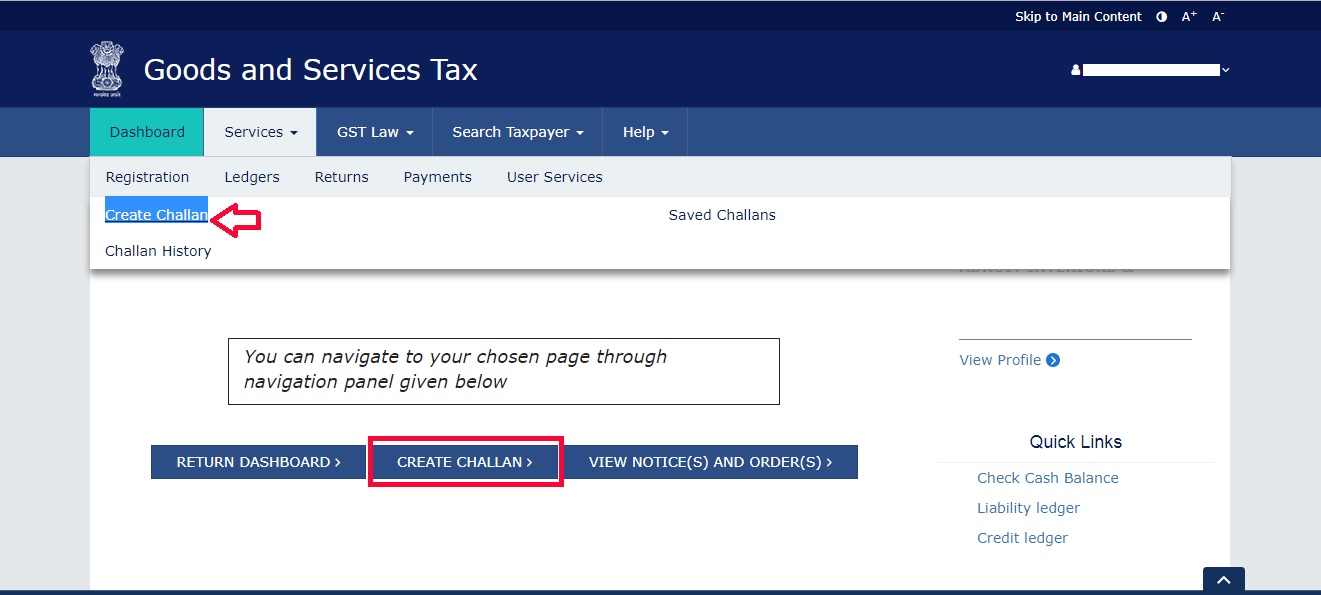

- Now to create a tax challan, either click on “Create Challan” that is displayed on dashboard or Go to Services tab >> Payments >> Click “Create Challan”

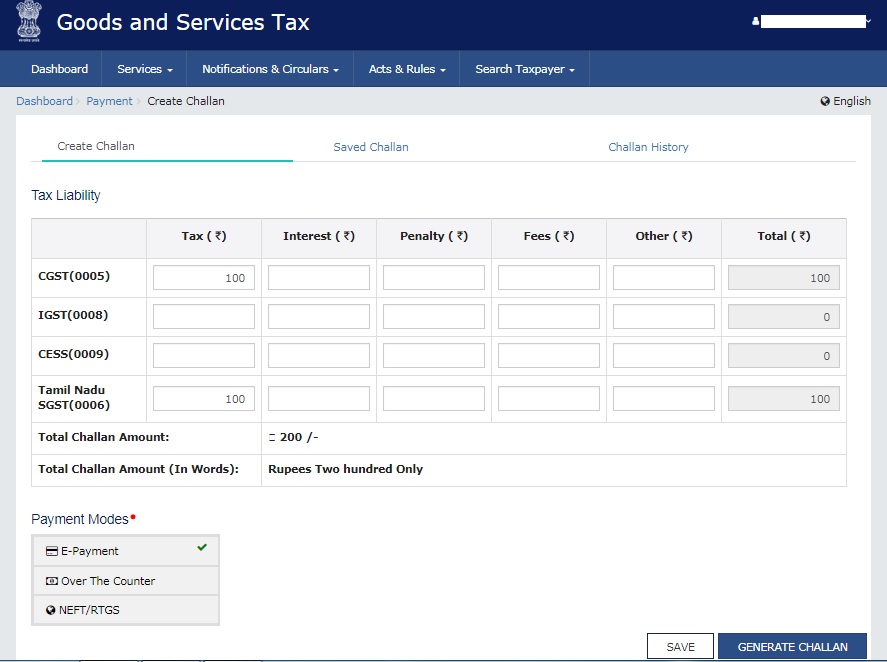

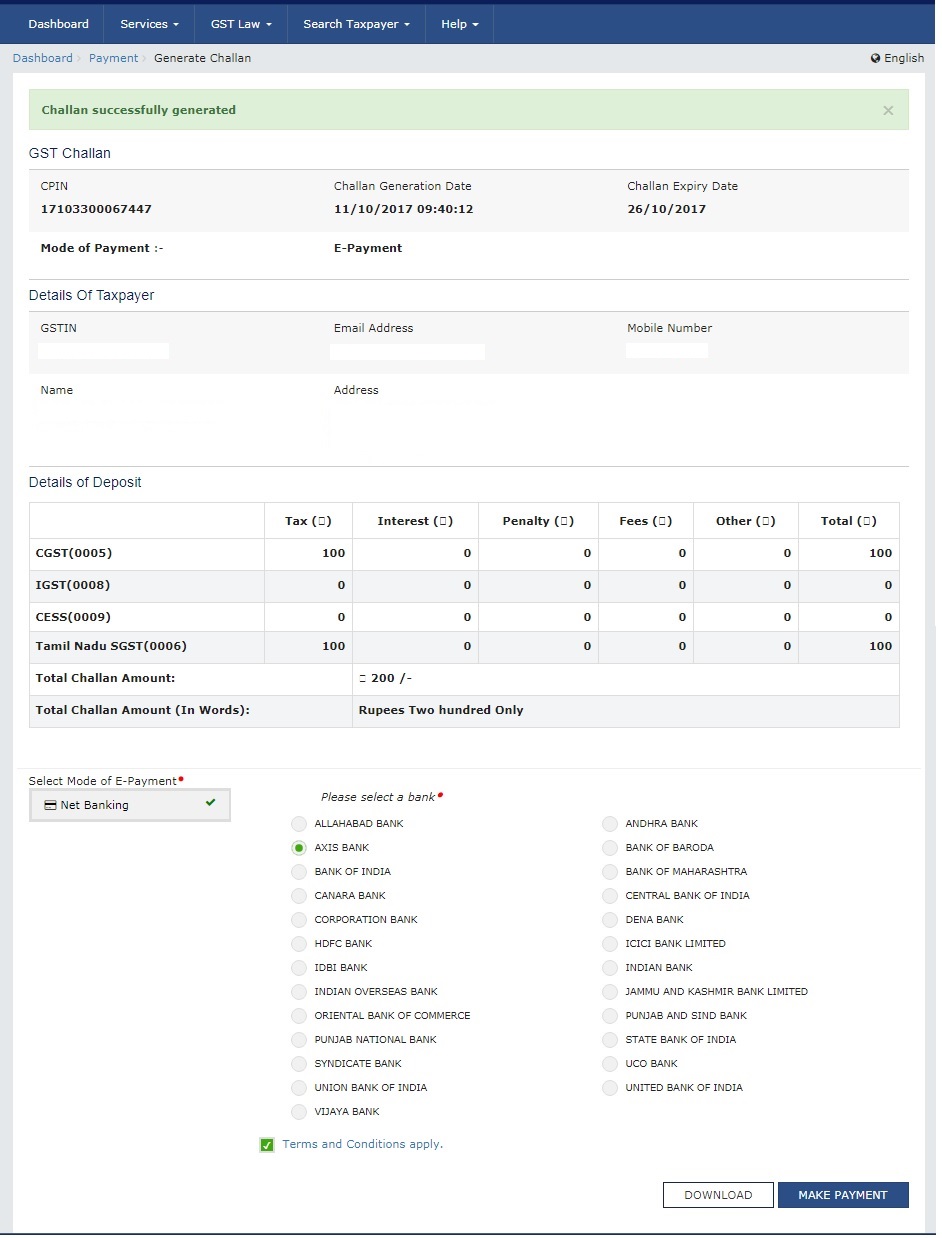

- Enter the amount to be paid in the respective columns, then select either of the Payment Modes and click “Generate Challan”. Else, click “Save” to make GST payment later

- GST Payments can be done using the following modes:

-

- E-Payment – Internet banking through authorised banks

- Over The Counter – Deposits upto Rs.10000 per challan per tax period, by cash, cheque or Demand Draft (DD)

- NEFT/RTGS – National Electronic Fund Transfer (NEFT) or Real Time Gross Settlement (RTGS) from any bank

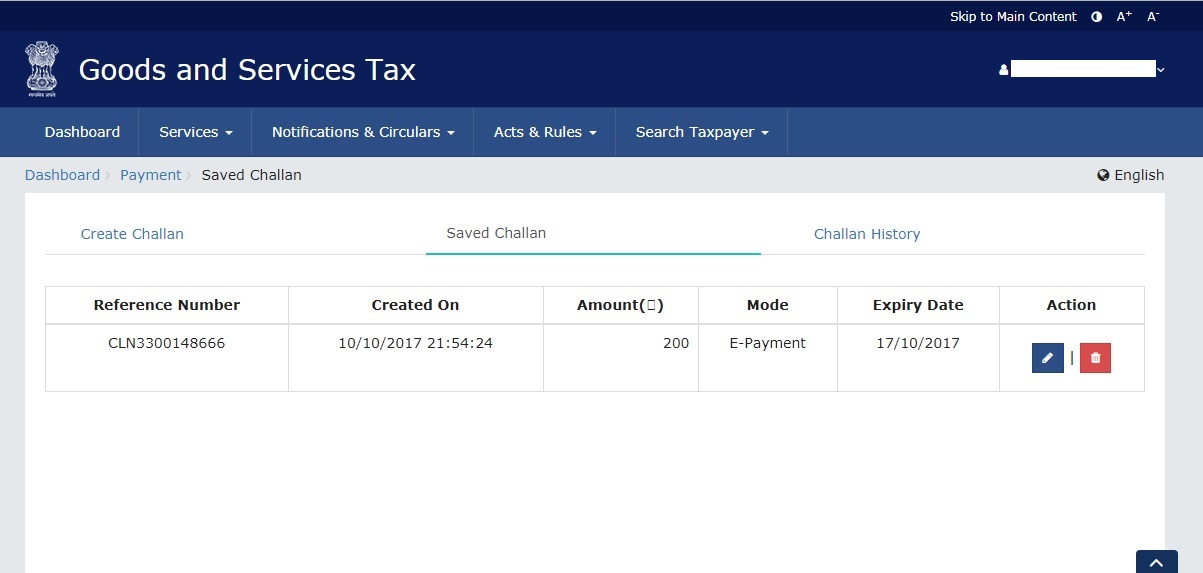

- Challan that is saved can be viewed under Services tab >> Payments >> “Saved Challan”. Check the expiry date and make the GST payment before the challan expires.

- After successful challan generation, verify the details that is displayed on the screen and click “Make Payment”, the page will redirect to the respective bank site.

- If payment mode is Over The Counter or NEFT/RTGS, then“Download” the challan, produce the same to any of the authorized banks and make the payment

- Once the GST payment is done, the challan can be viewed under Services tab >> Payments >> “Challan History”. Thereafter the amount will be credited to the Electronic Cash Ledger account.

If any queries or looking for any help on this, please visit us at https://www.reachaccountant.com

/0.png)

/1.png)

/2.png)

/3.png)

/4.png)

/5.png)

/6.png)

/7.png)