Click here to try a GST Accounting and Return Filing Tool for free

Export Procedure Under GST has specific benefits and are simplified to make compliance easier for exporters. Exports include supplies made to an SEZ. Exporters can export either under a Letter of Undertaking or Bond and claim refund of their unutilised input credit or export on payment of IGST and claim refund of the IGST so paid.

Let us take a look at the procedures outlined by the law and how they are beneficial to the exporter.

What are zero-rated supplies?

The following supplies of goods or services or both will attract GST at 0%:

- Exports of goods or services or both

- Supply pf goods or services or both to a Special Economic Zone Developer or Special Economic Zone Unit

There reason for the law to declare the above supply of goods or services or both at 0% (and not nil rated or exempt) is to allow the exporter of such supplies to avail the input credit accumulated in making these supplies. Such input credit may be utilised to pay output tax on other taxable supplies made by the exporter or claimed as a refund as the case may be.

Please read Refunds under GST and Input Credit under GST to know more about the procedure for refunds and criteria to avail input credit respectively.

What is the meaning of deemed exports, export of goods, export of services, special economic zone developer and special economic zone unit under GST?

Export of Goods:

Export of goods means taking of goods out of India to a place outside India i.e. only the movement of goods is relevant and not the location of the importer or exporter. Also, the receipt of money for such supplies in convertible foreign exchange is also not a pre-requisite for determining the supply as export of goods.

Illustration

ABC located in Kolkata approaches PQR located in Bangalore to supply goods to its manufacturing unit XYZ located in Sri Lanka. Payment for such supplies is made by ABC to PQR in INR.

Based on the above meaning of export of goods, the supply made by PQR will qualify to be an export supply.

Export of Services:

Export of services means supply of any service when:

- The supplier of service is located in India

- The recipient of service is located outside India

- The place of supply of service is located outside India

- The payment for such supply is received in Convertible Foreign Exchange

- The supplier of service and receiver of service are not establishments having the same Permanent Account Number but a separate GST Registration Number owing to their location or nature of business

Special Economic Zone Developer:

Special Economic Zone Developer covers the following persons:

- Person/ State Government who has been granted Letter of Approval by the Central Government

- Special Economic Zone Authority

- Co-Developer

Special Economic Zone Unit:

A unit set up in a Special Economic Zone (SEZ).

Deemed Exports:

Deemed exports are exports which are notified as deemed exports where:

- The goods are manufactured in India

- The supply of goods is to a place within India

- The payment for such supply is received in Indian Rupees/ Convertible Foreign Exchange

As per the Foreign Trade Policy 2015-20, supply of goods or services or both to the following shall be considered deemed exports:

- Supply of goods against Advance Authorisation / Advance Authorisation for annual requirement / DFIA;

- Supply of goods to EOU / STP / EHTP / BTP;

- Supply of capital goods against EPCG Authorisation;

- Supply of marine freight containers by 100% EOU (Domestic freight containers-manufacturers) provided said containers are exported out of India within 6 months or such further period as permitted by customs;

However, no deemed exports have been notified under the GST Law yet. Hence supply to all of the above will be liable to regular rates of taxes as per the GST Laws.

Based on other provisions of the GST Law, supply of goods or service or both to an SEZ will be deemed exports.

What are the options available for the exporter of goods and/or services for making the export (including deemed export) supply?

There are two options available for exporter of goods or services or both for making the export supplies:

- An exporter may supply goods or services or both under Bond or Letter of Undertaking in GST RFD 11, without payment of integrated tax and claim refund of unutilised input tax credit

- An exporter may supply goods or services or both, on payment of integrated tax and claim refund of such tax paid on goods or services or both supplied

What is the procedure to export goods or services or both under Bond or Letter of Undertaking?

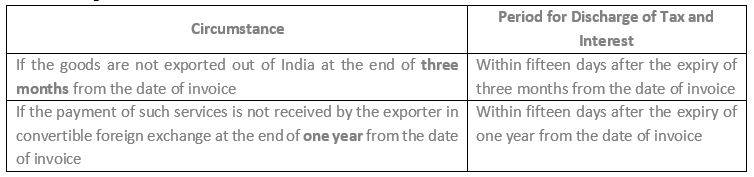

Before making the export, the exporter shall furnish a bond or a Letter of Undertaking in FORM GST RFD-11, to the jurisdictional Deputy/Assistant Commissioner, binding himself to pay the tax due along with interest at 18% in the following circumstances:

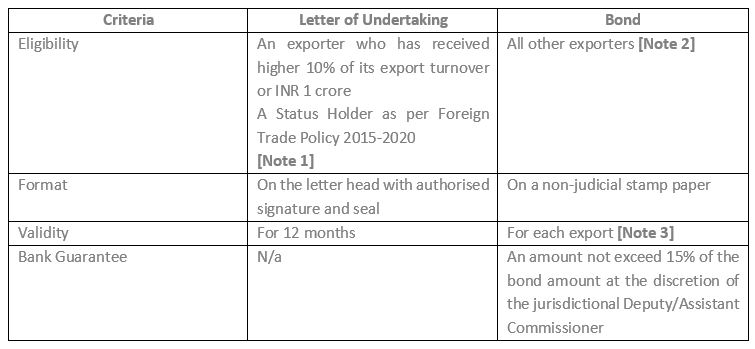

What is the difference between a Bond and a Letter of Undertaking?

Note 1: The exporter has not been prosecuted for any offence under the GST Law or under any of the existing laws in case where the amount of tax evaded exceeds two hundred and fifty lakh rupees.

Note 2: At the discretion of the jurisdictional Deputy/Assistant Commissioner a LUT may be accepted instead of a bond for:

- Supplies of goods to Nepal or Bhutan or SEZ developer or SEZ unit will be permissible irrespective of whether the payments are made in Indian currency or convertible foreign exchange as long as they are in accordance with applicable RBI guidelines.

- Supply of services to Nepal or Bhutan or SEZ developer or SEZ unit only if the payment for such services is received by the supplier in convertible foreign exchange.

Note 3: The exporters may choose to furnish a running bond, in FORM GST RFD -11 in case of multiple export supplies. The bond should cover the amount of tax involved in the export based on estimated tax liability as assessed by the exporter himself. In case the bond amount is insufficient to cover the tax liability in yet to be completed exports, the exporter will furnish a fresh bond to cover such liability.

Where the exporter chooses to export (including deemed export) goods or services or both on payment of IGST and claim refund of such tax paid on goods or services or both supplied, can he collect the IGST from the recipient of the supply?

Where the exporter chooses to export (including deemed export) goods or services or both on payment of IGST and claim refund of such tax paid on goods or services or both supplied, he cannot collect the IGST from the recipient of the supply. The exporter should pay this amount upfront before making the export.

Please read Returns and Payment under GST to understand the procedure for making payments.

We need to understand that under both the options available to the exporter for making the export supplies, what is required is for the exporter to provide a guarantee equivalent to the tax on the supplies in case of any default by the exporter. The option can be chosen by the exporter based on the volume of exports, eligibility and convenience of compliance.

If an exporter of goods or services or both (including deemed exports) is engaged in making taxable supplies within India, can he use the unutilised credit to pay the taxes on such taxable supplies made within India?

Yes. Where an exporter of goods or services or both (including deemed exports) is engaged in making taxable supplies within India, he can use the unutilised credit to pay the taxes on such taxable supplies made within India.

If an exporter of goods or services or both (including deemed exports) is engaged in making exempt supplies within India, can he claim refunds of the unutilised credit on inputs used to make the exempt supplies within India?

Yes. Where an exporter of goods or services or both (including deemed exports) is engaged in making exempt supplies within India, he can claim refunds of the unutilised credit on inputs used to make the exempt supplies within India.

What should be the contents of an export invoice?

The export invoice should mandatorily contain the following contents:

- Name, address and GSTIN of the supplier

- A consecutive serial number

- Date of its issue

- Name, address and GSTIN or UIN, if registered, of the recipient

- Name and address of the recipient and the address of delivery, along with the name of the country

- HSN code of goods or Accounting Code of services

- Description of goods or services

- Quantity in case of goods and unit or Unique Quantity Code thereof

- Total value of supply of goods or services or both

- Taxable value of supply of goods or services or both taking into account discount or abatement, if any

- Signature or digital signature of the supplier or his authorized representative

- An endorsement “SUPPLY MEANT FOR EXPORT ON PAYMENT OF INTEGRATED TAX AT X%” or “SUPPLY MEANT FOR EXPORT UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX”, as the case may be

Should the exporter of goods or services or both (including deemed exports) be registered under the GST Law?

As per the provisions of the GST Law, export supplies (including deemed exports) are considered as inter-state supplies. Further, the law provides that any person making an inter-state supply should be mandatorily registered.

Hence, irrespective of the turnover of the exporter, he should be registered under GST for making export supplies (including deemed exports).

Note: An SEZ unit or developer must make sure that they only procure goods or services or both from persons registered under GST.

Should a Company having more than one SEZ unit obtain a separate registration for each unit?

A Company having a SEZ Unit or being a SEZ developer should obtain a separate registration as a business vertical distinct from its other units outside the SEZ. [Refer Illustration]

Where the Company has multiple units in the same SEZ or across multiple SEZs in the same State, then one registration for all the units would suffice.

A separate registration for units in other States must be taken.

What is the tax impact on inter unit transfers in the same SEZ and supplies between two SEZs?

All inter unit transfers in the same SEZ and supplies between two SEZs will be considered as zero rated supplies.

Illustration

XYZ is in the business of supply food and restaurant services. They have multiple outlets across the State including a few in the food courts of SEZ units.

What is the tax impact on supplies made by XYZ’s branches in the SEZ units? Should he obtain a separate registration for the branches in the SEZ as a business vertical distinct from other units outside the SEZ?

Only a supply made to a SEZ developer or SEZ unit will be considered as zero-rated supplies.

Hence, in the above scenario, if XYZ has a contract with the SEZ unit for supply of food and restaurant services to its employees where the payment for such services is made by the SEZ Unit, then such supplies will be considered zero-rated supplies.

Where, the XYZ provides such service directly to the employees, then it will be taxable at 12%/18% as the case may be.

A separate registration for the branches in the SEZ as a business vertical distinct from other units outside the SEZ is not required as this provision is only applicable to the SEZ Unit or a SEZ developer and not for XYZ.

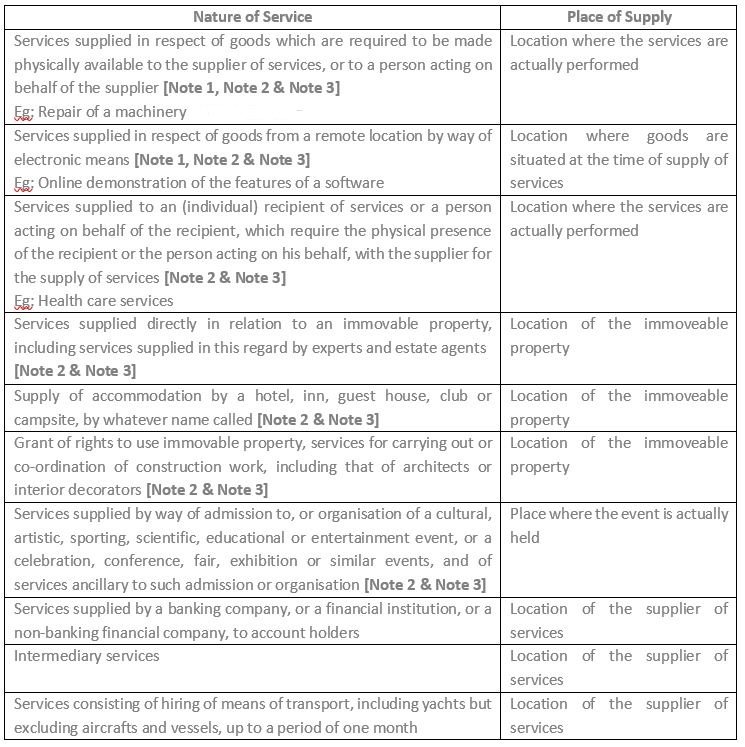

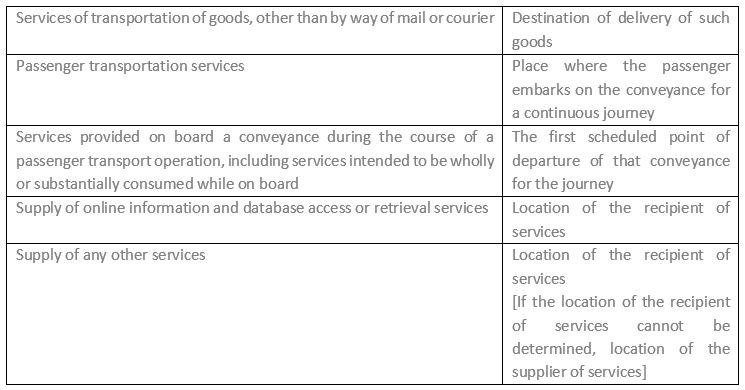

How to determine the place of supply for goods or services?

To determine whether a supply of goods or services are export (including deemed export) supplies, it is first important to understand the place of supply of such goods or services.

Goods:

Where goods are supplied to a location outside of India, it will be considered as exports.

Services:

Note 1:

This does not apply in the case of services supplied in respect of goods which are temporarily imported into India for repairs and are exported after repairs without being put to any other use in India.

Note 2:

Where these services are supplied in multiple locations including a location in the taxable territory, the place of supply shall be the location in the taxable territory.

Note 3:

Where these services are supplied in more than one State or Union territory, the place of supply of such services shall be each of the respective States or Union territories and the value of such supplies specific to each State or Union territory shall be in proportion to the value for services separately collected or determined in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other basis as may be prescribed

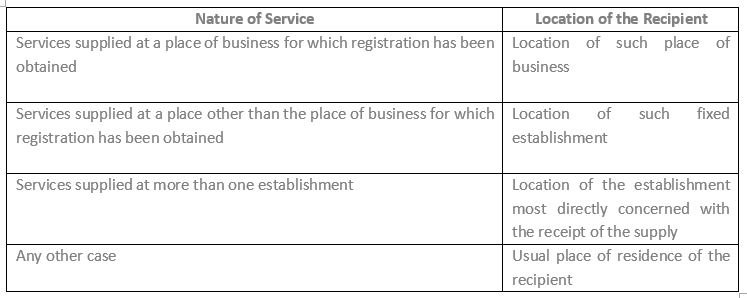

What are the criteria to be considered in determining the location of the recipient of services?

Location of the recipient of services will be:

Who is the recipient of supply of services?

Recipient of supply of services means:

- Where a consideration is payable for the supply of services, the person who is liable to pay the consideration;

- Where no consideration is payable for the supply of a service the person to whom the service is rendered;

Any reference to a person to whom a supply is made shall be construed as a reference to the recipient of the supply and shall include an agent acting as such on behalf of the recipient in relation to the services supplied.

Who is the recipient of supply of goods?

Recipient of supply of goods means:

- a) Where a consideration is payable for the supply of goods, the person who is liable to pay the consideration;

- b) Where no consideration is payable for the supply of goods, the person to whom goods are delivered or made available, or to whom possession or use of the goods is given or made available;

And any reference to a person to whom a supply is made shall be construed as a reference to the recipient of the supply and shall include an agent acting as such on behalf of the recipient in relation to the goods supplied.

/0.png)

/1.png)

/2.png)

/3.png)

/4.png)

/5.png)

/6.png)

/7.png)

can a unit in STP issue LUT/Bond for export of services

Hi Prakash,

STP units are treated on par with units in DTA under the GST Act. Hence, they can export under LUT/ Bond or on payment of IGST.

Regards,

Bhavana Nagendra

As per almost website information on jobwork under gst is very good and every thing is clear except export from jobworker on behalf of pricipal manufacture.We are a registered jobwoker and also domestic manufacturer located in mp and our another group company which is only a export house located in mumbai MH.They supplied us raw material without cover of challan from raw material supplier’s premises and we have taken excise credit of that material in our 23A cenvat account and also utilsed for our domestic supplies.As per old excise rules every thing was valid .we also got rebate for excise duty in case of export(after payment of duty under rule18).but after gst implementation we are unable to understand how to supply finished goods directly for export because we charge only for processing and assessable value of export goods is not in present gst invoice rule.previously we made export under principal mfg company bond and clear the Excise duty as per rule.But how to raise the invoice now in Gst .please help us if you can .we do not want to block our group company money for Igst rebate as export is zero rated .Every article and gst circular is showing that goods can be directly export from jw premises without payment of duty and aggregate TO will be added in principal company TO.But how it will be differentiate as per accounting and Gstr 1 it is not clear.please reply with your views.

Thanks & regards

Sandeep dubey