MYOB MALAYSIA

MYOB MALAYSIA (company) MYOB, Mind Your Own Business, is an Australian multinational corporation that provides tax, accounting and other services to small and medium businesses. Ideal for owner-operators, MYOB MALAYSIA Accounting helps you process sales and purchases, track receivables, payables and GST, email your quotes and invoices and more – all with the click of a few buttons. MYOB MALAYSIA Accounting avoids accounting jargon and is easy to use. Its award winning design guides you through the automation of your accounts, making it easy to track all your accounting data

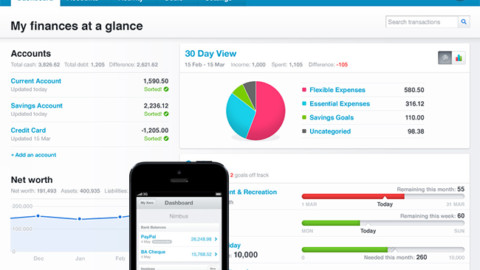

FEATURES OF MYOB MALAYSIA

- Easy to use

- Know your cash position

- Check your business health

- Send invoices and manage debtors

- GST compliant

- Inventory Management

- Multiple currencies

PRODUCTS OF MYOB MALAYSIA

- Accounting

- Payroll

- Customer relationship management

- Job management

- Human resource Management

- Retail and professional tax products

PRICING

The main selling point of MYOB MALAYSIA is that it is such a well-known and reliable brand. For small businesses with an outside accountant or bookkeeper, MYOB MALAYSIA allows online collaboration so that you can both access your accounts and keep up-to-date on the state of the business. Even your other employees who need real-time business information can access it online.

There are several MYOB MALAYSIA plans, all of which offer a free trial.

- BankLink: a simple bank feeds service

- Essentials Payroll for 1: $29/month

- Essentials Unlimited Payroll: $40/month

- AccountRight Plus: $77/month

- AccountRight Premier: $99/month

- Exo Business: software for larger, more complex businesses

5 Reasons to Consider Using MYOB MALAYSIA Accounting Software

Every business has an accounting method no matter how disorganised. If you are like a lot of small business owners, you are likely to have a manual system (using Excel for example); but, while using spreadsheets may seem simpler to you because you are used to it, it is not always best. In fact, it is neither easier nor more efficient than using a computerised system such as MYOB, so it may be time to rethink how you do accounts.

5 Reasons to Switch to MYOB MALAYSIA

MYOB MALAYSIA or (Mind Your Own Business) is a computerised accounting package that gives you the ability to handle your business finances like a professional. The benefits are many and once you use the program correctly you should start reaping them immediately. Additionally, using this (or another) computerised system can help you cut the cost of bookkeeping or accounting outsourcing fees.

1) Faster input: Manual entries can be more time consuming. This is especially so when you have to be creating headings or labels as you go alone. As a matter of fact, manual systems can require multiple entries per transaction and are likely to be more complex. The more complex the system the more time it will take.

2) Greater cost cutting: A computerised accounting package like MYOB offers up-to-date, accurate and easy to access financial information. This means that audit and accounting expenses will be much less than they are likely to be with a complex manual system that only you can readily understand

3) Makes GST filing easier: Having all the information compiled makes running any report you need easy. Plus, programs like MYOB automatically create the figures you will need to file a normal GST return. This saves you from having to sift through multiple sheets attempting to extract details.

4) Quick access to management information: The state of your business finances is important because it will help you plan for the future as well as make wise decisions in the present. This means that being able to study things like your business’ cash flow, sales records and order invoices is important as well. Using a program like MYOB makes generating reports and invoices easy, so you do not waste time extracting and sifting through data in order to run reports.

5) Improved accuracy: Having less areas to fill in means you are less likely to make errors that can cost you time and money. This is so because these types of software often require just one figure for each transaction. This makes it easier to keep track of the task as well as to double check entries.

The list of benefits to a program such as MYOB is far longer, but the main point is clear. These programs save you time and money, make your work easier, as well as help you to be more efficient. Luckily, a bookkeeper can help you get started on structuring your company finances and can show you how to maintain the order you achieve through your computerised accounting program.

DISADVANTAGES OF MYOB MALAYSIA

- Complicated to set up. Bit hard to get your head around at the start.

- Overly complex, features I do not need and cannot turn off.

- Lack of follow up assistance.

- Sometimes software mistakes appear while using it.

- Many times slow and unresponsive.

It costs a lot to maintain and stay current.

CLOUD ACCOUNTING SOFTWARE

If you want your business to work smarter and faster, cloud accounting software is a wise investment. Working in the cloud will give you a better overview of your finances, and improve collaboration with your team.

For many business owners, cloud accounting seems like a risk. Why trust your entire operation’s financial information on a server somewhere you can’t see? As it turns out, cloud accounting is the safest way to keep all of your records. Not only does it allow for flexibility – you can work on your files anywhere you have an internet connection – but it’s also more secure. Your information is kept in large data centres with more backup systems and redundancies that you most likely have in your own business.

At MYOB, we know that changing a technology strategy isn’t easy, and it can’t be done overnight. So we’ve brought together a collection of resources here to help and educate. Read up on why cloud accounting is such a powerful business tool – and how you can use cloud-based accounting to make your life, and the lives of your clients, even easier.

Cloud-based accounting can change your practice. Move to the cloud and give your business the flexibility to grow and succeed.

Cloud accounting is simply using the internet to access software rather than physically installing it on a computer. Many people are actually using cloud computing without realising it. For example anyone with Hotmail or Gmail accounts are already “in the cloud” as the software and data is stored remotely and is accessible from any computer, not just your computer.

Cloud accounting, also known as “online accounting”, serves the same function as cloud computing. You might install the software on your computer but it runs on servers and you can access it using your Internet. In some instances, you won’t need to install the software on your computer and can access it via web browsers.

As a small business owner, you might be concerned about a cloud service provider storing your data. But the cloud is one of the most secure ways to store information. For example, using cloud software, if your laptop is stolen, no one can access your data unless they have a login to the online account. With cloud software, this is where the data lives – as opposed to on your hard drive.

In the event of a natural disaster or fire, being in the cloud means business productivity doesn’t need to be affected because there’s no downtime. All of your information is safely and securely stored off site. As long as you have access to any computer or mobile device connected to the internet, you’re back up and running.

In addition to this, if you invite users to view your data, you can control the level of access. This is much more secure than the old-fashioned way of emailing your files or sending out a USB stick with your data on it.

Cloud-based software companies ensure that the security and privacy of data about you and your organisation is always airtight. If you use online banking, then you’re already primed to use cloud accounting.

Cloud based accounting software offers a number of benefits for businesses including:

- The cloud alleviates the need for businesses to store and manage data and maintain expensive computer hardware. You can operate the software from a single computer with a standard modem providing an internet connection, without being connected to a server or having specific software installed on the computer;

- The information can be updated and accessed from any computer anywhere in the world;

- There is only one ledger kept and that is the file in the cloud, which improves the accuracy of the information and therefore minimises errors at BAS and tax time;

- The ability for owners to interact with their accountant in real time instead of having to send the data file to the accountant each time;

- A monthly access fee is paid which usually works out less than the cost of buying the software and then paying for annual subscriptions; and

- The software is automatically kept up-to-date by the provider meaning that you don’t need to download updates such as new tax rates where the payroll module is used.

- You have a clear overview of your current financial position, in real-time.

- Multi-user access makes it easy to collaborate online with your team

and advisors. - Automatic updates mean you can spend more time doing what you love.

- Everything is run online, so there’s nothing to install and everything is backed up automatically. Updates are free and instantly available.

- Upfront business costs are reduced – version upgrades, maintenance, system administration costs and server failures are no longer issues. Instead, they are managed by the cloud service provider.

Problems with traditional accounting software

- The data in the system isn’t up to date and neither is the software.

- It only works on one computer and data bounces from place to place. For example, on a USB drive. This is not secure or reliable.

- Only one person has user access. Key people can’t access financial and customer details.

- It’s costly and complicated to keep backups (if done at all).

- It’s expensive, difficult and time consuming to upgrade the software.

- Customer support is expensive and slow.

Why the cloud and accounting software are the perfect match

You can use cloud-based software from any device with an internet connection. Online accounting means small business owners stay connected to their data and their accountants. The software can integrate with a whole ecosystem of add-ons. It’s scalable, cost effective and easy to use.

In the cloud, there’s no need to install and run applications over a desktop computer. Instead, you pay for the software by monthly subscription.

Business owners can access their data anytime from anywhere. Business owners are always on the move and are increasingly using tablets and smart phones to access latest financial data. With cloud accounting, they can see the business account balances, outstanding invoices, overall cash position and much more from anywhere 24/7 as long as they can access an internet connection.

Cost of ownership is lower as compared to traditional accounting softwares. There is nothing to install and maintain. Software updates automatically without user intervention. This results in overall reduction in cost. This enables small business owners to focus on the core business activities.

Cloud Accounting is secure. Normally, proper security measures are not implemented by small businesses to protect their financial data. Cloud Accounting softwares like ProfitBooks maintain high security standards. Backups are taken at regular intervals, servers are scanned for vulnerabilities and data is transferred over the encrypted connection.

Online Accounting Softwares are integrated with other services. For example, ProfitBooks can be integrated with popular file sharing application Dropbox to store and share files. There are endless possibilities to extend the functionality by connecting with other online softwares.

It brings the entire team together. Cloud accounting enables business owners and accountants to work on the same file simultaneously eliminating the need of data transfer and physical meetings.

WHY CLOUD ACCOUNTING IS BETTER COMPARED TO MYOB

| Product Name | MYOB |

| No. of Locations you can access from | Only the installed computer |

| No. of users who can access at the same time | 1 |

| No. of Companies you can create | 5 |

| Userbased restriction on which companies they can work on | Not possible |

| Devices you can use to access | Computer only |

| CRM | Not Available |

| Sales Team Management (Like Salesforce with Mobile App for executives) | Not Available |

| Freeze Entries by Owner | Not Available |

| Payroll | Not Available |

| Automatic back up every 3 hours to protect Hard disk crash | Not Available |

| Data Recovery in case of Crash | Not Available |